Gold IRA Companies, THCa, Delta 9, Peptides, and Mushrooms for Retirement

In the ever-evolving landscape of retirement making plans, contributors are regularly searching for inventive ways to shield their financial future. One such strategy that has received awareness is the 401(ok) to gold IRA rollover. This system now not only diversifies retirement portfolios yet also hedges in opposition to inflation and marketplace volatility. In this entire article, we will discover the myriad blessings of transitioning from a classic 401(k) to a gold-sponsored Individual Retirement Account (IRA). As we delve into the intricacies of this fiscal maneuver, we are going to discover how it could possibly be an fundamental portion of your long-term retirement method, providing you with defense and peace of intellect as you manner goldiracompanies.substack.com your golden years. A 401(okay) plan is an service provider-backed retirement savings account that lets in worker’s to save and make investments a component in their paycheck beforehand taxes are taken out. Contributions are in general matched through employers, making them an wonderful option for constructing retirement wealth. Despite their blessings, usual 401(okay)s include obstacles. High charges, restrained investment options, and vulnerability to market fluctuations can impede boom plausible. A Gold IRA is a self-directed Individual Retirement Account that lets in buyers to preserve actual gold bullion or cash as component of their retirement portfolio. This shape of diversification enables look after against economic downturns. When contemplating the transition from a 401(ok) to a Gold IRA, it’s important to apprehend what makes this shift so necessary. The rollover job involves transferring price range from your present day 401(ok) plan without delay into a brand new Gold IRA with no incurring taxes or consequences. Here’s the way it works: Before proceeding with the rollover, that is necessary to locate an IRS-approved custodian who specializes in handling gold IRAs. Look for companies with strong reputations and clear price platforms. Once you will have specific your custodian, you’ll be able to want to open an account specially specified for containing priceless metals. Contact your recent 401(k) plan administrator and request the worthy kinds for rolling over your account steadiness into your new Gold IRA. After finishing up the forms, payments shall be transferred at once from your vintage account into your new one devoid of triggering tax liabilities. With payments now possible for your Gold IRA account, you can purchase licensed gold bullion or coins simply by your custodian. While rolling over from a 401(ok) to gold can present quite a lot of advantages, timing is quintessential. Consider those points: No funding technique comes devoid of disadvantages; working out those abilities pitfalls can help navigate them successfully: | Feature | Traditional Investments | Gold IRAs | |—————————-|————————|————————-| | Tax Treatment | Tax-deferred | Tax-deferred | | Market Dependency | High | Low | | Inflation Hedge | Limited | Strong | | Control Over Assets | Limited | High | You can put money into IRS-approved gold bullion or cash that meet particular purity requisites (pretty much .995% natural). If done accurately using direct move tips among accounts, there are no consequences or taxes incurred during the rollover task. Yes! You have the choice to roll over all or section of your stability right into a Gold IRA based to your economic targets. Look for custodians with tremendous reports, remarkable licensing and insurance coverage insurance plan in addition to clear charge structures. Once you’ve got you have got rolled over finances into your new account, you must adhere to annual contribution limits set by IRS instructions for IRAs. Your newly accepted Gold IRA continues to be yours in spite of employment adjustments; although, you is not going to roll over additional price range till assembly selected criteria set by way of IRS rules. In conclusion, making the strategic circulate from a classic 401(ok) plan to a Gold IRA can particularly toughen your retirement portfolio whilst safeguarding in opposition to fiscal uncertainties and inflation risks. By unlocking wealth by using this rollover technique—knowledge its blessings and navigating its complexities—you position yourself favorably for lengthy-time period fiscal fulfillment during retirement years ahead! Remember that each and every fiscal selection deserve to align with someone dreams and occasions; consulting with economic advisors experienced in priceless metallic investments is sensible previously making massive variations like this one! In abstract, no matter if you’re looking at diversifying investments or defensive yourself in opposition to marketplace fluctuations—curious about Unlocking Wealth: The Benefits of a 401(okay) to Gold IRA Rollover for Your Retirement Strategy might alright be one key facet closer to attaining lasting fiscal independence! In the ever-evolving landscape of retirement making plans, men and women are regularly in the hunt for cutting edge methods to at ease their economic long run. One such technique that has gained attention is the 401(ok) to gold IRA rollover. This method not handiest diversifies retirement portfolios yet additionally hedges in opposition to inflation and industry volatility. In this entire article, we will be able to explore the myriad advantages of transitioning from a basic 401(ok) to a gold-sponsored Individual Retirement Account (IRA). As we delve into the intricacies of this financial maneuver, we are going to uncover how it may be an essential part of your long-time period retirement procedure, proposing you with defense and peace of mind as you strategy your golden years. A 401(k) plan is an agency-backed retirement rate reductions account that facilitates worker’s to retailer and make investments a portion in their paycheck before taxes are taken out. Contributions are more commonly matched through employers, making them an appealing selection for building retirement wealth. Despite their merits, average 401(okay)s come with obstacles. High prices, restrained funding alternatives, and vulnerability to marketplace fluctuations can restrict enlargement ability. A Gold IRA is a self-directed Individual Retirement Account that permits traders to continue physical gold bullion or coins as component of their retirement portfolio. This model of diversification facilitates protect in opposition to monetary downturns. When all for the transition from a 401(ok) to a Gold IRA, it’s most important to realise what makes this shift so really helpful. The rollover method contains moving payments from your recent 401(okay) plan in an instant into a new Gold IRA devoid of incurring taxes or consequences. Here’s the way it works: Before proceeding with the rollover, that’s fundamental to find an IRS-authorized custodian who makes a speciality of coping with gold IRAs. Look for corporations with stable reputations and clear commission buildings. Once you have chosen your custodian, you could need to open an account specially special for holding useful metals. Contact your latest 401(ok) plan administrator and request the imperative kinds for rolling over your account stability into your new Gold IRA. After finishing the office work, budget will probably be transferred right now out of your antique account into your new one with out triggering tax liabilities. With finances now accessible on your Gold IRA account, you should buy approved https://goldiracompanies.substack.com/p/401k-to-gold-ira-rollover gold bullion or cash with the aid of your custodian. While rolling over from a 401(okay) to gold can be offering countless advantages, timing is significant. Consider these components: No investment procedure comes with no risks; realizing these prospective pitfalls will let you navigate them simply: | Feature | Traditional Investments | Gold IRAs | |—————————-|————————|————————-| | Tax Treatment | Tax-deferred | Tax-deferred | | Market Dependency | High | Low | | Inflation Hedge | Limited | Strong | | Control Over Assets | Limited | High | You can spend money on IRS-accredited gold bullion or coins that meet one of a kind purity criteria (in most cases .995% natural). If done adequately with the aid of direct transfer tactics between money owed, there are no penalties or taxes incurred for the period of the rollover strategy. Yes! You have the choice to roll over all or element of your balance into a Gold IRA depending to your financial pursuits. Look for custodians with triumphant experiences, gorgeous licensing and coverage insurance plan as well as obvious charge systems. Once you’ve rolled over dollars into your new account, you would have to adhere to annual contribution limits set by IRS directions for IRAs. Your newly well-known Gold IRA stays yours notwithstanding employment alterations; despite the fact, you should not roll over extra money until meeting explicit criteria set via IRS laws. In end, making the strategic transfer from a ordinary 401(okay) plan to a Gold IRA can substantially improve your retirement portfolio at the same time safeguarding opposed to fiscal uncertainties and inflation dangers. By unlocking wealth because of this rollover process—know-how its reward and navigating its complexities—you location your self favorably for long-term financial success right through retirement years ahead! Remember that each monetary selection could align with unique ambitions and circumstances; consulting with monetary advisors skilled in useful metallic investments is sensible ahead of making valuable ameliorations like this one! In abstract, no matter if you are looking at diversifying investments or keeping your self in opposition t marketplace fluctuations—considering the fact that Unlocking Wealth: The Benefits of a 401(okay) to Gold IRA Rollover for Your Retirement Strategy may possibly o.k. be one key edge toward achieving lasting fiscal independence! Gold has actually long been thought about a reputable store of worth, a financial investment that can hold up against the examination of financial uncertainties. For newbies venturing into the world of gold investment, recognizing the ins and outs involved is vital to making educated decisions. In this short article, we will certainly discover “A Newbie’s Journey into Gold Financial Investment with Augusta,” concentrating on how Augusta Precious Metals can assist you via your first steps in gold investment. Gold isn’t just shiny steel; it’s a hedge versus rising cost of living and a safe haven during financial slumps. So, why should you take into consideration buying gold? And how does Augusta Valuable Metals suit the picture? Let’s dive in. Gold has been treasured for thousands of years, not just for its beauty yet additionally for its inherent value. From ancient civilizations using it as money to modern capitalists crowding to it during situations, gold continues to be a timeless asset. Starting any type of investment journey can feel frustrating– where do you also begin? For newbies, augusta precious metals gold ira reviews partnering with a trustworthy company like Augusta Rare-earth elements can simplify the procedure considerably. They concentrate on assisting brand-new capitalists through their first steps and help make notified choices. Before diving rashly into acquisitions, it’s necessary to know the different types of gold financial investments offered: Understanding these alternatives will certainly help customize your investment approach effectively. Augusta Precious Metals has constructed a track record as a trustworthy partner for those looking to invest in rare-earth elements. Their concentrate on education and learning sets them in addition to competitors. They encourage capitalists by offering detailed resources regarding the nuances of buying gold. One standout function is their tailored consumer support– their team walks you with every step and addresses your questions promptly. This straightforward procedure guarantees you’re not left going to pieces when establishing your investment. Once your account is set up, it’s time to pick what kind of gold items align with your monetary goals: Augusta gives thorough summaries and market evaluations for every product– making it less complicated for you to pick wisely. The cost of gold changes based upon various variables including: Being familiar with these variables assists brand-new financiers navigate market volatility effectively. When investing via Augusta Precious Metals, it’s important to understand any connected charges: Transparency helps make certain there are no surprises along the way! Investing in physical gold suggests taking into consideration safe and secure storage choices: Augusta supplies support on safe storage space remedies tailored for peace of mind. Investing in precious metals brings certain tax obligation commitments: Consulting tax obligation experts or making use of resources offered by Augusta can clarify these complexities. Augusta mostly concentrates on gold and silver yet likewise provides platinum and palladium options depending on market demands. Yes! While all financial investments carry dangers, physical gold has a tendency to be less unpredictable than supplies and is much less vulnerable to financial turmoil. You can market your holdings back with Augusta or any kind of other respectable dealership offering affordable rates based upon current market prices. Absolutely! With a self-directed IRA facilitated by Augusta, you can invest directly in physical rare-earth elements within your retired life cost savings plan. Minimum acquisition amounts differ based upon product kind; nevertheless, newbies typically find options suitable even at lower budget plans through Augusta’s offerings. Augusta offers webinars, short articles, e-books, and one-on-one examinations developed particularly for novice capitalists browsing the globe of priceless metals. Embarking on “A Newbie’s Trip right into Gold Financial Investment with Augusta” supplies promising potential customers for both riches conservation and growth prospective in the middle of financial uncertainty. By partnering with professionals like those at Augusta Rare-earth elements, newbies acquire indispensable understandings that demystify the complexities surrounding rare-earth element financial investments while ensuring they make educated decisions tailored specifically to their monetary goals. Whether you’re attracted by historic importance or looking towards future security through substantial properties like gold– recognizing the fundamentals gears up every investor with knowledge required to browse this amazing venture successfully! In recent years, the health and wellness neighborhood has actually accepted a fascinating beverage that merges the natural flavors of mushrooms with the beloved ritual of coffee. Yes, we’re discussing mushroom coffee! This one-of-a-kind mix not just entices your palate however also supplies possible health advantages that could boost your day-to-day regimen. However how do you select top-notch mushroom coffee amidst a sea of options? In this detailed guide, we’ll unwind everything you require to understand about choosing high quality mushroom coffee, from understanding its benefits to identifying the most effective brands on the market. Mushroom coffee is a blend made from ground coffee beans mixed with medical mushrooms like Lion’s Mane, Chaga, Reishi, and Cordyceps. This combination aims to improve mental clearness, boost power degrees, and advertise overall health while providing an unique flavor profile that differs from routine coffee. The beginnings of mushroom coffee can be traced back to standard practices in numerous cultures where mushrooms have actually been prized for their medicinal properties. Cultures in China and Japan have long made use of mushrooms in their diet regimens for both cooking and wellness functions. The modern-day pattern started getting traction in the West as individuals looked for all-natural options to boost their health. Mushroom coffee isn’t simply a fashionable drink; it includes numerous potential wellness benefits: Mushrooms like Lion’s Mane are recognized for their neuroprotective residential or commercial properties. They might help improve memory, emphasis, and overall cognitive function. Chaga mushrooms are loaded with antioxidants that might strengthen the body immune system, assisting your body repel ailments extra effectively. Reishi mushrooms are often described as “the mushroom of everlasting life.” They are thought to help reduce stress and anxiety degrees while advertising relaxation. Cordyceps mushrooms can boost physical performance by raising oxygen uptake and enhancing endurance– best for athletes or those looking to power through their workouts. When browsing the globe of mushroom coffee, it’s important to understand what distinguishes top quality items from poor ones. Below’s a detailed approach to making a notified choice. Not all mushroom coffees are created equal. Some brands use whole mushrooms, while others count on mycelium (the origin framework). Whole mushrooms generally provide much more nutrients contrasted to mycelium-based products. Look for brand names that focus on lasting sourcing methods. Organic accreditations make certain that no damaging pesticides or chemicals were made use of throughout cultivation. The removal method used can substantially impact strength and flavor: Choose a brand name that utilizes both methods for maximum benefit! Mushroom coffee has an unique preference that may take some getting used to: Experimenting with various brand names can help you discover one that lines up with your taste buds preferences. If you’re seeking the most effective mushroom coffee alternatives offered today, consider these trustworthy brands recognized for high quality: |Trademark name|Trick Active ingredients|Special Offering Point|| ——————|———————————–|————————————|| Four Sigmatic|Lion’s Mane, Chaga|Instantaneous packages offered|| RISE Developing Carbon Monoxide|Lion’s Hair|Ready-to-drink canisters|| Superfood 100|Reishi|Organic qualification|| Mud Wtr|Blend of different mushrooms|Focus on adaptogenic homes| Each brand name uses something distinct– whether it’s preparation benefit or component selection– so examine what suits your way of life best! One usual question among new individuals is about caffeine material: Generally talking: This makes mushroom coffee a terrific different if you’re aiming to decrease high levels of caffeine intake without compromising power levels! If you’re feeling adventurous and desire full control over your components, making your very own mushroom coffee is an excellent option! Yes! Nevertheless, those allergic to particular fungi need to seek advice from a medical care specialist first. Generally regarded as secure; however, too much consumption may lead to digestive upset in some individuals. Keep it in a trendy, dark place away from dampness– ideally https://washingtonbeerblog.com/mushroom-coffee-the-rise-of-functional-beverages-for-health-and-wellness/ in an impermeable container– to keep freshness. Absolutely! Many people appreciate it daily because of its balanced caffeine material and added wellness benefits. Yes! Immediate alternatives offer comfort while ground variations provide richer tastes when brewed fresh. No! The kinds of mushrooms made use of don’t consist of psychoactive substances connected with hallucinogenic effects. Choosing premier mushroom coffee doesn’t need to be intimidating! By recognizing what active ingredients are beneficial and taking into consideration variables such as sourcing techniques and extraction techniques, you can with confidence pick the very best items on the marketplace today! With many tastes readily available alongside amazing wellness benefits– what’s stopping you from diving into this amazing realm? Explore different brand names until you find one that reverberates with both your palate and wellness objectives– it might just become your new favored morning routine! Currently go ahead– brew yourself a mug filled with potential! By following this guide on “Every little thing You Required to Know About Picking Top-notch Mushroom Coffee,” you’re fully equipped for an experience into healthier living without jeopardizing on taste or enjoyment! In today’s uncertain monetary landscape, investors are continuously looking for much safer and much more profitable opportunities to safeguard their retired life funds. The discussion between conventional investments, such as stocks and bonds, and different possessions like gold has acquired momentum recently. This short article looks into the details of Gold vs. Standard Investments: Making the Switch Over from 401k to IRA, discovering the benefits and drawbacks of each financial investment kind, while additionally offering a roadmap for those thinking about a 401 k to Gold IRA Rollover As we browse this facility topic, it’s essential to arm ourselves with understanding concerning market fads, historical efficiency, and possible dangers connected with various kinds of financial investments. By doing so, you’ll be better geared up to make enlightened decisions that straighten with your monetary goals. Traditional investments generally include assets such as stocks, bonds, mutual funds, and property. These have actually been the go-to choices for many capitalists due to their liquidity and ease of access. Gold has long been considered as a benkou.substack safe house during times of financial unpredictability. Its innate worth typically aids secure versus inflation and currency devaluation. When contrasting gold and conventional investments, one must think about danger resistance levels. While traditional investments might offer higher returns gradually, they also come with enhanced volatility. An in-depth look at historical information reveals exactly how both asset courses have actually carried out over decades: |Year|Stock Market Return (%)|Gold Price Rise (%)|| ——|————————-|————————-|| 2000|-9|5|| 2008|-37|5|| 2020|+18|+25| Investors ought to consider their financial investment horizon when choosing between these two options: A Gold Individual Retired life Account (IRA) is a customized retirement account that allows you to spend straight in physical gold or various other rare-earth elements while enjoying tax obligation benefits comparable to conventional IRAs. Understanding tax obligation implications is vital when considering a rollover: Can I surrender my entire 401k right into a Gold IRA? Yes, you can transfer all or part of your funds right into a Gold individual retirement account without tax charges if done correctly. Are there restricts on how much I can add to my Gold IRA? Yes, yearly contribution limitations apply likewise just like traditional IRAs– examine internal revenue service guidelines for current figures. Will I pay tax obligations when I surrender my 401k right into a Gold IRA? Not if you do a direct rollover; indirect rollovers might incur taxes otherwise carried out properly within permitted timelines. What kinds of gold can I hold in my Gold IRA? Accepted forms include American Eagles, Canadian Maple Leafs, bars from identified refiners, and so on, abiding by internal revenue service standards. Is it risk-free to invest all my retired life financial savings into gold? It’s advisable not to place all your eggs in one basket; diversification throughout possession classes mitigates danger effectively. How do I choose the ideal custodian for my Gold IRA? Try to find custodians with strong reputations, openness in charges and solutions used; customer reviews additionally aid considerably here. Choosing in between gold and conventional financial investments involves evaluating various elements including danger resistance, financial investment goals, and market problems while thinking about techniques like the 401 k to Gold IRA Rollover Both investment types have their one-of-a-kind benefits and drawbacks; hence assessing individual conditions thoroughly prior to making any shifts is paramount. In summary, understanding each choice’s intricacies will certainly empower you with understandings needed for building a resilient retirement profile tailored specifically for you– one that safeguards against inflation while maximizing growth possibility via calculated diversity in between tangible possessions like gold alongside typical opportunities such as stocks or bonds! Ultimately (and probably most notably), it has to do with making notified options based on dependable details– so take charge today! When it comes to retired life planning, individuals frequently seek means to maximize their financial investments while decreasing risks. One option that has actually acquired traction recently is transforming a traditional Person Retired life Account (INDIVIDUAL RETIREMENT ACCOUNT) right into a gold-backed IRA. The appeal of purchasing gold originates from its historical stability and capacity for development, particularly throughout financial declines. Nonetheless, the inquiry remains: Is transforming your individual retirement account to gold right for you? In this detailed overview, we’ll look into vital factors to consider bordering this financial investment strategy, attending to every little thing from regulatory implications to market volatility. A Person Retired life Account (IRA) is a tax-advantaged investment account developed to help people save for retired life. There are several types of IRAs, consisting of standard, Roth, SEP, and SIMPLE IRAs. Each type has its own collection of guidelines concerning contributions, withdrawals, and tax obligation implications. Gold has actually long been considered as a safe-haven property. It often tends to retain its worth gradually and can serve as a bush versus inflation and economic instability. As such, many capitalists think about adding gold to their portfolios when seeking to expand their holdings. Converting your individual retirement account right into gold entails a number of steps: When you convert 401k convert IRA to gold guide an existing individual retirement account right into a gold-backed account, it’s important to understand the possible tax obligation consequences: The financial setting heavily affects the rate of gold: |Year|Gold Cost Adjustment (%)|S&P 500 Modification (%)|| ——|———————–|———————|| 2010|+25%|+12%|| 2015|-11%|-0.73%|| 2020|+25%|+16%| To maintain conformity with internal revenue service policies when transforming your IRA to gold: A trustworthy custodian need to have: Yes, many kinds of IRAs can be converted into a self-directed account that permits rare-earth element investments. If done appropriately with straight transfers without taking possession yourself first, there should not be fines involved. You can buy IRS-approved coins and bullion such as American Eagles and specific bars fulfilling pureness standards. Consider consulting with an economic expert who understands both your personal economic objectives and market conditions. Fees may consist of management charges billed by your custodian in addition to storage space fees associated with securing your physical assets. Yes! When saved correctly with an authorized custodian in an accepted facility, physical properties like bullion are normally secure. In recap, choosing whether or not to convert your typical IRA into a golden chance involves careful factor to consider of various elements– ranging from specific economic goals and risk tolerance levels to understanding market dynamics and regulatory requirements regulating rare-earth elements financial investments in retired life accounts. While investing in precious metals like gold can boost profile diversification and act as a rising cost of living hedge throughout unclear times– it’s important not just to consider these advantages versus feasible disadvantages but also continue to be informed regarding ongoing market patterns when making such substantial choices regarding retired life savings strategies! Ultimately– whether you like taking the plunge or simply exploring choices– it’s always a good idea to speak with knowledgeable specialists that focus on these locations before continuing down this path! Mushroom coffee has actually Best mushroom coffee for healthy lifestyle taken the wellness world by tornado, and for good reason. Combining the abundant, acquainted flavor of coffee with the wellness advantages of medicinal mushrooms, this one-of-a-kind drink uses a fascinating choice to your early morning brew. If you’ve ever before wondered about the buzz surrounding mushroom coffee or are merely curious concerning just how to integrate it right into your day-to-day regimen, you have actually involved the right place! This comprehensive overview will certainly walk you through whatever you need to understand to discover the best mushroom coffee customized especially for beginners. When embarking on your trip right into the world of mushroom coffee, understanding its beginnings and advantages is necessary. In this area, we’ll explore what mushroom coffee is, exactly how it’s made, and why it’s become a prominent selection among health and wellness enthusiasts. Mushroom coffee blends traditional ground coffee with powdered essences from various medicinal mushrooms. These mushrooms are renowned for their health and wellness advantages and are thought to enhance cognitive function, increase immunity, and give sustained power without the anxieties related to regular coffee. Typically, mushroom coffee can be prepared similar to routine coffee. You can make use of instantaneous blends or ground versions that require brewing with methods such as French press or drip brewing. The trick is ensuring that you’re utilizing top notch removes to gain maximum health benefits. If you’re still on the fence concerning trying mushroom coffee, think about these compelling factors: With many choices offered in today’s market, just how do you pick the best mushroom coffee? Right here are some essential factors you’ll want to take into consideration: When looking for the best mushroom coffee, constantly focus on brand names that resource top notch ingredients. Try to find items labeled as organic and devoid of fillers or additives that may interfere with their nutritional value. Different mushrooms use numerous benefits; therefore, understanding which types are included in your blend is essential. If you’re looking for cognitive enhancement, go with items featuring Lion’s Mane. Not all mushroom coffees include high levels of caffeine; some blends are totally caffeine-free while others include varying levels of high levels of caffeine from standard beans. Taste matters! Some brand names may have a more powerful earthy flavor as a result of their mushroom material; others may be much more well balanced with a durable coffee taste. Researching consumer evaluations and brand reputation can provide understandings right into product effectiveness and quality control practices. Here’s a check out some leading brands known for generating extraordinary mushroom coffees: |Brand|Secret Ingredients|High levels of caffeine Level|Price Array|| ——————|———————-|—————–|—————|| Four Sigmatic|Lion’s Mane & & Chaga|Tool|$$|| Rasa|Adaptogenic blend|Reduced|$$|| Mud/WTR|Reishi & & Chaga|Caffeine-free|$$$|| Organo Gold|Ganoderma Lucidum|Tool|$$| Each brand name brings something distinct to the table– explore different options will assist you discover what fits ideal with your preferences! Preparing mushroom coffee is quick and very easy! Below’s a straightforward overview that’ll get you started: Follow package instructions concerning offering dimension– usually one tbsp per mug is standard yet readjust according to taste preference. For split second blends: For ground variations: Enhance your drink with milk or sugar if desired– some individuals delight in including seasonings like cinnamon or vanilla too! Sip gradually and enjoy each beneficial cup! Despite its expanding popularity, numerous misconceptions persist around mushroom coffee; allow’s clear some misconceptions! Reality: Lots of people discover that well-crafted blends supply a delicious taste profile that rivals typical coffees. Reality: The ancient use medical mushrooms dates back centuries; they’re not simply trendy! Reality: Many people eat it frequently without unfavorable impacts; nonetheless, small amounts is crucial– just like any supplement! Now let’s dive deeper into some certain wellness benefits attributed to routine consumption of mushroom coffee: The presence of Lion’s Mane mushrooms has actually been connected to boosted memory retention and emphasis as a result of its neuroprotective properties. Chaga consists of beta-glucans which support immune reaction– making it a superb choice throughout influenza season! Reishi works as an adaptogen assisting equilibrium anxiety levels– perfect when life obtains hectic! 1. Just what is in mushroom coffee? Mushroom coffee commonly integrates ground coffee beans with powdered extracts from medicinal mushrooms such as Lion’s Mane, Chaga, Reishi, or Cordyceps. 2. Does it taste like regular coffee? Yes! While there may be refined differences due to added mushrooms’ earthiness, several discover it pleasantly comparable in flavor. 3. Can I drink it every day? Most individuals can safely enjoy mushroom coffee daily; nevertheless, audiences must monitor their body feedback closely. 4. Is there any kind of high levels of caffeine in all varieties? Not all varieties include caffeine; some brands provide entirely caffeine-free alternatives while others have actually moderate levels based on bean content. 5. Where can I acquire top notch brands? You can find trusted brand names online through their websites or systems like Amazon– just guarantee they stress quality sourcing practices! 6. Are there any kind of side effects? Normally speaking– when consumed properly– the adverse effects are minimal however private responses may differ depending on individual sensitivities toward particular ingredients utilized within blends. After exploring this extensive overview on finding the very best mushroom coffee customized especially for beginners– from recognizing what makes up this ingenious drink– to learning just how ideal prepare it– we wish you feel equipped enough currently dive right into experimenting yourself! With numerous wellness benefits at risk combined together with delightful tastes awaiting discovery– you have actually got just experience ahead! So why wait any kind of longer? Embark upon your journey today towards unlocking both deliciousness + wellness with a mixture of fungi goodness onto early morning regimens anywhere! Happy sipping! Gold has been a sign of wide range and success for centuries. From old people that used gold as money to modern portfolios that seek security, the attraction of gold continues to be solid. As we browse via unpredictable economic environments and changing markets, financiers commonly transform their stare toward this precious metal. However why purchase gold? Insights from leading investment firms reveal a multifaceted solution that encompasses wealth preservation, inflation hedging, and profile diversification. In this thorough article, we’ll discover the myriad reasons why individuals and organizations are investing in gold today. We’ll look into experienced opinions from several of the best gold investment companies, examine historic patterns, and provide practical advice on just how to get started with your very own gold financial investments. Gold has actually transcended time and societies as a form of wealth. Its distinct buildings– scarcity, divisibility, durability– make it a suitable medium for profession and savings. Ancient Egyptians hidden their pharaohs with treasures made from gold, thinking it would certainly accompany them into the afterlife. Gold prices have actually seen different fluctuates throughout background: Portfolio diversification includes spreading financial investments across various possession classes to handle run the risk of much better. By consisting of gold in your portfolio, you can decrease volatility and boost returns. Gold generally shows reduced correlation with equities and bonds: Inflation wears down acquiring power in time; nonetheless, traditionally, gold tends to hold its value also Best Gold Investment Companies for physical gold when fiat currencies shed theirs. Leading investment company say that allocating 5% to 10% of your profile to gold can mitigate risks associated with inflation. During durations of geopolitical stress or financial declines, financiers flock to gold as a safe haven: Investors can choose various kinds for their gold investments: |Type|Description|Pros|Cons|| ——————–|————————————–|——————————————|————————————|| Physical Gold|Coins & & bars|Concrete property; inherent value|Storage space & & insurance policy expenses|| ETFs|Exchange-traded funds|Easy trading; no physical storage required|Management charges|| Mining Stocks|Shares in gold mining firms|Potential for high returns|Market volatility| Navigating the world of gold investing calls for assistance from reputable companies: Understanding guidelines is essential when buying any asset course: Investing doesn’t have to be discouraging if you follow these actions: While there are lots of advantages, potential risks must not be neglected: Gold rates can rise and fall dramatically based on global financial conditions. Not all forms of gold are quickly convertible into cash without possible loss. Investors frequently debate whether they ought to adopt a long-term or short-term technique when investing in gold. Long-term Strategy Short-term Strategy Yes! Physical gold provides intrinsic worth yet includes storage space costs. Absolutely! Lots of firms use individual retirement account options especially for precious metals. Capital gains tax applies upon marketing your financial investments at a profit. Financial advisors advise designating 5% to 10% of your profile towards priceless metals. Some dealerships bill premiums over spot costs or include shipping prices; constantly ask beforehand! Diversifying throughout different properties is normally recommended rather than counting solely on one type. In recap, purchasing gold offers countless benefits that extend past simple speculation– it acts as a hedge versus rising cost of living, a stabilizer within diversified portfolios, and a protect throughout unstable financial times. Insights from leading investment company attest that incorporating physical or paper types of this rare-earth element can yield considerable lasting benefits while securing against financial uncertainties. The journey toward investing sensibly might seem overwhelming in the beginning look; nevertheless, being educated equips you to make audio decisions backed by information and expertise from a few of the best companies readily available today. If you’re considering adding this ageless property to your financial approach, now’s the excellent time to explore better! So why wait? Study the globe of gold chances today! In today’s fast-paced world, where every moment counts, numerous are on the lookout for means to enhance their wellness. With the surge of superfoods, a certain contender stands out in the world of health and wellness and health: mushroom coffee. This delightful blend not only promises a high levels of caffeine boost however likewise brings the myriad benefits of medical mushrooms. If you’re curious concerning exactly how to renew your everyday routine while delighting in tasty coffee, you remain in for a treat! In this write-up, we’ll delve into the most effective mushroom coffees readily available today, explore their advantages, and offer understandings into why they may just be the game-changer you’re looking for. Mushroom coffee is an unique mix that combines traditional coffee with powdered medical mushrooms. These fungi have been used for centuries in various societies for their health benefits. By integrating them right into coffee, fanatics think they can delight in both the taste of their favorite drink and the restorative advantages of mushrooms. Over recent years, there’s been a rise in popularity bordering mushroom coffee. Its charm exists not simply in its possible health advantages however likewise in its capability to supply an alternative to standard caffeinated drinks without causing jitters or crashes. To create mushroom coffee, makers usually begin with top quality coffee beans and combine them with powdered forms of various medical mushrooms such as Lion’s Mane, Chaga, Reishi, and Cordyceps. The outcome is a flavorful beverage that merges the abundant preference of coffee with the natural notes of mushrooms. Choosing mushroom coffee over standard mixtures can have numerous benefits: Four Sigmatic has actually taken a niche for itself as one of the leading brand names in this ingenious area. Their mushroom coffee mix integrates organic Arabica beans with Lion’s Hair and Chaga extracts. RISE offers an one-of-a-kind mix that integrates adaptogenic ingredients along with its mushroom elements. Each package assures sustained power with no crashes. This blend features instant mushroom powder combined with exceptional quality coffee beans sourced from lasting farms. Mud/ Wtr takes an innovative strategy by incorporating different active ingredients alongside its mushroom base. Its chai mix offers an aromatic experience unlike any other. Om offers an organic choice that weds both convenience and wellness benefits perfectly– suitable for those that want fast preparation without giving up quality. Mushroom coffees harness the power of a number of vital mushrooms understood for their diverse wellness advantages: Lion’s Hair has actually amassed focus because of its neuroprotective residential properties that might sustain cognitive function and memory enhancement. Known as “the king of mushrooms,” Chaga is lauded for its antioxidant homes which assist combat oxidative stress. Often referred to as “the mushroom of everlasting life,” Reishi might advertise relaxation and far better sleep quality. Cordyceps are identified for improving physical performance by raising ATP manufacturing– perfect post-workout fuel! Brewing your perfect mug of mushroom coffee involves greater than just adding hot water to a mix– it Best mushroom coffee for focus has to do with creating an experience! Integrating superfoods like mushroom coffees into your everyday ritual can bring about enhanced wellness results while providing you with sustained energy throughout your day. Picture waking up each morning excited to brew a cup that not only tastes superb however fuels your body like never before! 1. Is mushroom coffee safe?Unlocking Wealth: The Benefits of a 401(ok) to Gold IRA Rollover for Your Retirement Strategy

Introduction

Understanding 401(ok) Plans

What is a 401(okay) Plan?

Key Features of a 401(ok)

Limitations of Traditional 401(okay) Plans

The Gold IRA Advantage

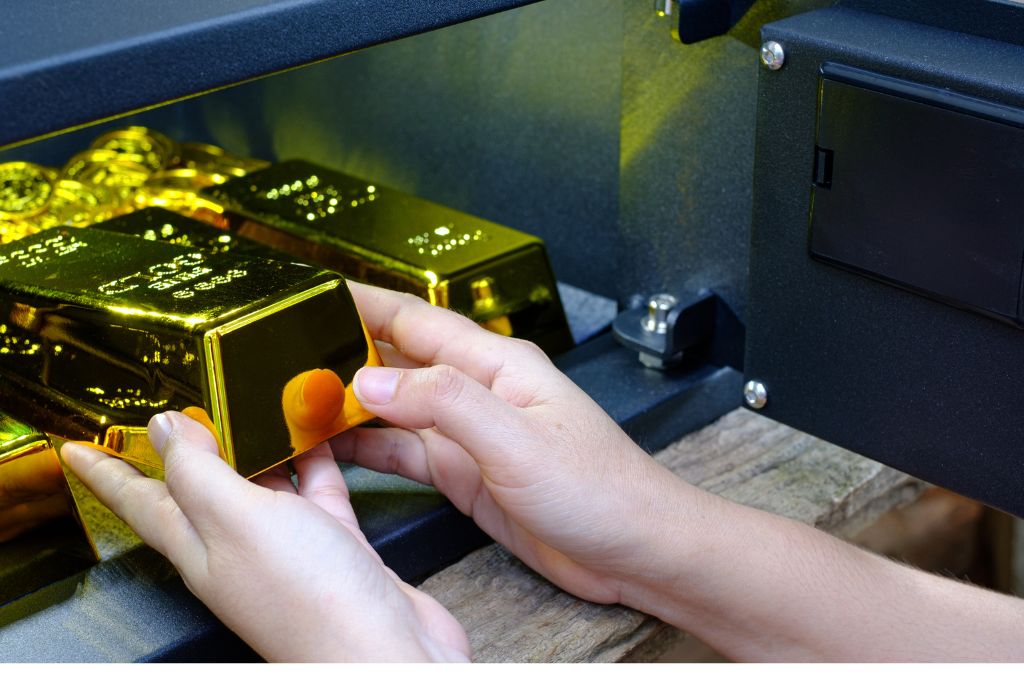

What is a Gold IRA?

Benefits of Investing in Gold Through an IRA

Unlocking Wealth: The Benefits of a 401(okay) to Gold IRA Rollover for Your Retirement Strategy

Why Consider a Rollover?

How Does the Rollover Process Work?

Step-through-Step Guide to Completing a 401(ok) to Gold IRA Rollover

Step 1: Research Potential Custodians

Step 2: Open Your New Gold IRA Account

Step three: Initiate the Rollover Request

Step 4: Fund Your New Account

Step five: Purchase Precious Metals

Factors Influencing Your Decision on Rollover Timing

Risks Associated with Investing in Gold IRAs

Table Comparing Traditional Investments vs. Gold IRAs

FAQs about the 401(ok) to Gold IRA Rollover

FAQ #1: What different types of gold can I invest in through my Gold IRA?

FAQ #2: Are there any penalties for rolling over my 401(okay)?

FAQ #three: Can I roll over my entire balance from my 401(ok)?

FAQ #four: How do I want which custodian is true for me?

FAQ #5: Is there any restrict on contributions once I commence my rollover?

FAQ #6: What happens if I amendment jobs after rolling over?

Conclusion

Unlocking Wealth: The Benefits of a 401(ok) to Gold IRA Rollover for Your Retirement Strategy

Introduction

Understanding 401(k) Plans

What is a 401(okay) Plan?

Key Features of a 401(okay)

Limitations of Traditional 401(ok) Plans

The Gold IRA Advantage

What is a Gold IRA?

Benefits of Investing in Gold Through an IRA

Unlocking Wealth: The Benefits of a 401(k) to Gold IRA Rollover for Your Retirement Strategy

Why Consider a Rollover?

How Does the Rollover Process Work?

Step-through-Step Guide to Completing a 401(k) to Gold IRA Rollover

Step 1: Research Potential Custodians

Step 2: Open Your New Gold IRA Account

Step three: Initiate the Rollover Request

Step four: Fund Your New Account

Step five: Purchase Precious Metals

Factors Influencing Your Decision on Rollover Timing

Risks Associated with Investing in Gold IRAs

Table Comparing Traditional Investments vs. Gold IRAs

FAQs about the 401(ok) to Gold IRA Rollover

FAQ #1: What sorts of gold can I spend money on through my Gold IRA?

FAQ #2: Are there any consequences for rolling over my 401(k)?

FAQ #three: Can I roll over my entire balance from my 401(okay)?

FAQ #four: How do I desire which custodian is precise for me?

FAQ #five: Is there any restrict on contributions as soon as I begin my rollover?

FAQ #6: What occurs if I substitute jobs after rolling over?

Conclusion

A Newbie’s Trip right into Gold Investment with Augusta

Introduction

Understanding Gold Investment: Why It Matters

The Historic Significance of Gold

Benefits of Buying Gold

A Newbie’s Journey into Gold Financial Investment with Augusta

Finding Your Course to Investment

Understanding Different Sorts of Gold Investments

Getting Started with Augusta Precious Metals

Why Pick Augusta?

Customer-Centered Approach

Setting Up an Account with Augusta Precious Metals

Making Your Initial Purchase with Augusta Precious Metals

Selecting Your Gold Products

Physical Gold Options Available

Understanding Pricing and Costs at Augusta Valuable Metals

What Influences Gold Prices?

Augusta’s Clear Fee Structure

Storage Choices for Your Physical Gold Investment

Where Ought to You Shop Your Gold?

Tax Effects of Buying Gold

Understanding Tax obligation Obligations as an Investor

FAQs

1. What kinds of precious metals does Augusta offer?

2. Is it secure to purchase physical gold?

3. How do I liquidate my rare-earth element investments?

4. Can I consist of gold in my retired life account?

5. Exist minimal purchase requirements?

6. What educational resources does Augusta provide?

Conclusion

Whatever You Required to Learn About Deciding On Premium Mushroom Coffee

Introduction

What is Mushroom Coffee?

The Origins of Mushroom Coffee

Health Benefits of Mushroom Coffee

1. Improved Cognitive Function

2. Immune Support

3. Tension Reduction

4. Boosted Power Levels

Everything You Need to Understand About Deciding On Top Quality Mushroom Coffee

1. Ingredients Issue: Whole Mushrooms vs. Mycelium

Why Choose Entire Mushrooms?

2. Sourcing and Sustainability

Key Inquiries to Ask:

3. Extraction Approaches: Hot Water vs Alcohol

Hot Water Extraction

Alcohol Extraction

4. Taste Profile: What To Expect

Common Taste Notes

Top Brands for Mushroom Coffee

How Much High levels of caffeine is in Mushroom Coffee?

Comparative High levels of caffeine Levels

How To Brew Your Own Mushroom Coffee at Home?

What You’ll Need:

Step-by-Step Directions:

FAQs About Mushroom Coffee

1. Can any individual drink mushroom coffee?

2. Does mushroom coffee have side effects?

3. Exactly how must I keep my mushroom coffee?

4. Can I consume alcohol mushroom coffee every day?

5. Is there a distinction in between instant and ground versions?

6. Will I obtain high from drinking mushroom coffee?

Conclusion

Gold vs. Traditional Investments: Making the Switch Over from 401k to individual retirement account

Introduction

Understanding Standard Investments

What Are Typical Investments?

Pros and Cons of Conventional Investments

Advantages of Typical Investments

Disadvantages of Standard Investments

The Situation for Gold as an Investment

Why Invest in Gold?

Benefits of Purchasing Gold

Hedge Against Inflation

Portfolio Diversification

Tangible Asset

Drawbacks of Buying Gold

Lack of Income Generation

Storage Costs

Gold vs. Conventional Investments: Secret Comparisons

Risk Assessment: Which is Safer?

Historical Efficiency Analysis

Investment Time Perspective: Temporary vs Long-term

Making the Shift: 401k to Gold Individual Retirement Account Rollover

What is a Gold IRA?

Steps for the 401k to Gold IRA Rollover Process

Tax Effects of Rolling Over Your 401k right into a Gold IRA

FAQs Regarding Switching from 401k to Gold IRA

Conclusion

Is Transforming Your Individual Retirement Account to Gold Right for You? Secret Considerations

Introduction

Understanding the Essentials of IRAs

What is an IRA?

Types of IRAs Explained

Why Take into consideration Gold in Your Retired Life Portfolio?

The Refine of Converting an IRA to Gold

How Do You Convert Your IRA to Gold?

Tax Ramifications of Converting Your Individual Retirement Account to Gold

Is Transforming Your individual retirement account to Gold Right for You? Secret Considerations

Benefits of Purchasing Gold through an IRA

Risks Associated with Gold Investments

Evaluating Market Problems Before Conversion

Current Economic Climate and Its Impact on Gold Prices

Table 1: Historical Efficiency of Gold vs Other Assets

Regulatory Considerations When Transforming Your IRA to Gold

IRS Regulations and Regulations on Precious Metals Investments

Choosing the Right Custodian for Your Gold Investment

FAQs Regarding Converting Your IRA to Gold

1. Can I convert any kind of sort of IRA into a gold-backed account?

2. Are there any kind of penalties for converting my traditional individual retirement account right into a gold-backed one?

3. What sorts of gold can I purchase through my self-directed IRA?

4. Just how do I understand if purchasing gold is suitable for my monetary situation?

5. What are the fees connected with having a self-directed gold-backed IRA?

6. Is my investment in physical gold truly secure?

Conclusion

Discover the most effective Mushroom Coffee: A Total Guide for Beginners

Introduction

Discover the most effective Mushroom Coffee: A Total Guide for Beginners

What Is Mushroom Coffee?

Types of Mushrooms Utilized in Coffee

The Brewing Process

Why Should You Think about Mushroom Coffee?

Choosing the Right Mushroom Coffee: Trick Factors

1. Quality of Ingredients

2. Kind Of Mushrooms Used

3. High levels of caffeine Content

4. Flavor Profile

5. Brand Reputation

Popular Brand names Offering Mushroom Coffee

How To Prepare Mushroom Coffee: A Detailed Guide

Step 1: Collect Your Contents & Tools

Step 2: Measure Your Ingredients

Step 3: Make Your Coffee

Step 4: Include Extra Ingredients

Step 5: Enjoy!

Common Myths Concerning Mushroom Coffee Debunked

Myth 1: It Does Not Taste Good

Myth 2: It’s Just a Fad

Myth 3: You Can’t Consume It Daily

Health Benefits of Drinking Mushroom Coffee Regularly

Enhanced Cognitive Function

Boosted Immune System

Stress Reduction

FAQ Section

Conclusion

Why Purchase Gold? Insights from Leading Investment Firms

Introduction

Why Purchase Gold? Insights from Leading Financial Investment Firms

1. The Historic Value of Gold

Historical Fads in Gold Prices

2. The Duty of Gold in Profile Diversification

What Does Diversification Mean?

Gold’s Low Connection with Other Assets

3. Inflation Hedge: Securing Your Wealth

How Does Gold Function as a Rising Cost Of Living Hedge?

Expert Viewpoints on Inflation Protection

4. Worldwide Economic Unpredictability and Gold’s Safe Haven Status

Economic Instability Sets off Gold Investments

5. Comprehending Various Kinds of Gold Investments

Physical Gold vs. Paper Gold

6. The Best Gold Investment Companies You Required to Know About

Top Firms for Purchasing Gold

7. The Regulatory Setting Surrounding Gold Investments

Key Rules Affecting Gold Trading

8. Just How to Start Buying Gold Today?

9. Dangers Associated with Buying Gold

Market Volatility

Liquidity Risk

10. Long-lasting vs Temporary Investment Strategies for Gold

FAQs about Purchasing Gold

1. Is investing in physical gold worth it?

2. Can I include gold in my retired life account?

3. What are the tax implications of offering my gold?

4. Just how do I establish the right amount of gold to invest?

5. Are there any surprise charges when buying gold?

6. Ought to I invest solely in gold?

Conclusion

Revitalizing Your Routine with Superfoods: A Take A Look At The Most Effective Mushroom Coffees

Introduction

What is Mushroom Coffee?

The Rise of Mushroom Coffee

How is Mushroom Coffee Made?

Why Pick Mushroom Coffee?

The Best Mushroom Coffees Readily Available Today

1. Four Sigmatic Mushroom Coffee Mix

Benefits

2. RISE Mushroom Coffee

Benefits

3. Laird Superfood Mushroom Coffee

Benefits

4. Mud/Wtr – Chai Blend

Benefits

5. Om Mushroom Superfood Coffee

Benefits

Health Benefits of Secret Mushrooms Utilized in Coffee Blends

Lion’s Hair: The Cognitive Enhancer

Chaga: The Immune Booster

Reishi: The Leisure Aid

Cordyceps: The Energy Producer

How to Brew Your Ideal Mushroom Coffee

Revitalizing Your Routine with Superfoods: A Look at The Best Mushroom Coffees

FAQs Concerning Mushroom Coffees

Absolutely! Lots of people enjoy it without side effects; nonetheless, if you have specific allergic reactions or problems, consult your healthcare provider first.

2. Can I consume mushroom coffee every day?

Yes! Many people incorporate it into their everyday regimens much like standard coffee– but moderation is key!

3. Does it taste like normal coffee?

While some blends preserve a similar taste account to standard brews, others might have a lot more natural touches due to the mushrooms used.

4. How much caffeine does mushroom coffee contain?

Commonly much less than conventional coffees; however, this varies by brand– always check labels!

5. Can youngsters consume mushroom coffee?

It’s ideal to seek advice from pediatricians prior to introducing any caffeinated items into children’s diets.

6. Where can I find high-quality mushroom coffees?

You can find them online via various sellers or specialty supermarket concentrated on natural products!

Conclusion

Mushroom coffees supply an exciting way to revitalize your routine while using nature’s extraordinary offerings– superfoods! From boosting cognitive feature and supporting resistance to decreasing high levels of caffeine reliance, these blends boast numerous advantages worth checking out further!

So why not take that jump today? Dive headfirst right into explore various brand names till you find what matches your palate best! Besides, when thinking about “Revitalizing Your Routine with Superfoods: A Look at The Most Effective Mushroom Coffees,” it’s everything about finding pleasure in every sip– and that wouldn’t desire that?

This short article gives a detailed review full of understandings on just how incorporating superfoods right into our routines can make impactful changes towards much better living criteria with delicious mugs full of goodness!

Debunking Gold IRAs: A Deep Dive into Top Firms

Introduction

In the ever-evolving landscape of individual finance, a growing number of capitalists are transforming their focus towards alternative properties. Amongst these assets, gold stands apart as a classic means of protecting riches. Go Into Gold Individual Retired Life Accounts (Individual Retirement Accounts), an one-of-a-kind investment vehicle that allows people to consist of rare-earth elements in their retirement portfolios. Yet how does one browse the complex globe of Gold IRAs? Which companies can be trusted to manage these financial investments? In this extensive write-up, we will certainly peel back the layers and debunk Gold IRAs, checking out the leading companies in the market and what they offer.

Demystifying Gold IRAs: A Deep Study Leading Companies

Gold Individual retirement accounts are specialized pension that make it possible for people to hold physical gold and other precious metals as component of their retirement savings. Unlike typical Individual retirement accounts that primarily buy supplies, bonds, or common funds, Gold IRAs give an opportunity for diversification with concrete assets.

What is a Gold IRA?

A Gold IRA operates similarly to a conventional individual retirement account but with distinct functions:

- Physical Ownership: Financiers can own real gold bullion or coins.

- Tax Benefits: Payments might be tax-deductible, and gains expand tax-deferred until withdrawal.

- Custodianship: Gold has to be held by an IRS-approved custodian.

Why Buy a Gold IRA?

Investing in a Gold IRA provides several benefits:

Understanding the Role of Custodians in Gold IRAs

Custodians play an important function in taking care of Gold IRAs:

- They deal with the purchase and storage space of your valuable metals.

- Ensure conformity with internal revenue service regulations.

- Provide account statements and help with transactions.

Types of Custodians

Choosing the Right Company for Your Gold IRA

Selecting the right firm can really feel daunting given the multitude of choices offered. Right here are some key variables to think about:

Reputation and Trustworthiness

Research the company’s history, customer reviews, and sector credibility. Web sites like the Better Business Bureau (BBB) or Trustpilot can provide understandings into client experiences.

Fees and Charges

Understand all linked costs:

- Setup fees

- Annual maintenance fees

- Storage fees

Transparent pricing is important for making notified decisions.

Customer Support

Look for firms that supply durable customer service. Whether it’s via phone, email, or live chat, having accessibility to well-informed representatives can make a substantial difference.

Top Firms Offering Gold IRAs

Now allowed’s dive deeper into some of the leading companies in the field of Gold IRAs:

1. Goldco Priceless Metals

Overview

Goldco has actually established itself as one of the premier providers in the sector considering that 2006.

Services Offered

- Self-directed silver and gold IRAs

- Precious steel sales

Customer Feedback

Goldco gathers high praise for its outstanding customer service and educational sources created for new investors.

2. Augusta Priceless Metals

Overview

Founded in 2012, Augusta Precious Metals focuses on informing its clients regarding buying gold and silver.

Services Offered

- Direct acquisitions of physical gold

- Comprehensive educational materials

Customer Feedback

Clients appreciate Augusta’s transparency pertaining to charges and processes which builds trust.

3. Birch Gold Group

Overview

Birch Gold Team has actually been energetic because 2003 and focuses on assisting clients transform their present retirement accounts into priceless metal-backed accounts.

Services Offered

- Rollovers from existing retirement accounts

- Silver, platinum, and palladium options

Customer Feedback

Birch has actually obtained positive testimonials for its customized solution customized to private investor needs.

Comparison Table of Top Companies

|Company Name|Year Established|Sorts Of Metals Supplied|Fees Framework|| ———————–|——————|————————|———————–|| Goldco|2006|Gold & & Silver|Clear|| Augusta Precious Metals|2012|Gold & & Silver|Affordable|| Birch Gold Team|2003|Multi-metal Choices|Clear Charge Set Up|

The Process of Setting Up a Gold IRA

Setting up your very own gold IRA could appear frustrating in the beginning glimpse; however, following these steps makes it convenient:

Step 1: Choose an IRA Custodian

This choice is vital since they handle your financial investments’ safety and security and conformity with regulations.

Step 2: Fund Your Account

You might either transfer funds from an existing retirement account or make brand-new contributions according to internal revenue service limits.

Step 3: Select Your Investments

Decide which types of rare-earth elements you ‘d like to consist of based on your financial investment method– taking into consideration variables such as liquidity and market trends.

How to Surrender Existing Retired Life Accounts right into a Gold IRA?

Rolling over existing accounts prevails amongst investors looking to branch out with precious metals:

The Value of Storage space Solutions for Your Priceless Metals

When investing in gold via an IRA, one can not ignore where those properties will certainly be kept:

Types of Storage space Options

Understanding Tax Implications Associated with Gold IRAs

Investing in a gold individual retirement account features details tax obligation factors to consider:

FAQs Concerning Investing in Gold IRAs

What kinds of metals can I hold in my gold IRA?

You can generally hold IRS-approved bullion coins like American Eagles or Canadian Maple Leafs together with bars made from licensed refiners meeting purity standards set by the IRS.

Are there any type of restrictions on selling my gold?

While you can market your gold holdings anytime after reaching retirement age scot-free, it’s advisable to linkedin consult your custodian regarding details standards or prospective taxes owed from sales profits.

Can I take physical ownership of my gold?

No! The IRS requireds that all financial investments within an IRA remain under custodian control till withdrawal occurs post-retirement age– making sure conformity with policies regulating retirement accounts.

What takes place if I die before withdrawing my funds?

Your successors will certainly inherit your account’s value without incurring prompt taxes; however circulations might lead them towards taxation depending upon exactly how they select to take out funds afterward!

How do I select between various custodian firms?

Evaluate each company’s service offerings against their reputations– think about seeking advice from independent review platforms while additionally factoring fee structures entailed when making any last decisions!

Is it worth it investing specifically within these kinds of Accounts?

Gold has actually historically worked as both wealth preservation & & inflation hedge– capitalists commonly see diversifying portfolios via such opportunities positively due both intrinsic value & & potential development possibilities presented by rare commodities like these!

Conclusion

Navigating the world of investment can occasionally seem like traversing undiscovered waters; nonetheless, understanding just how various aspects interact supplies clearness along this journey toward financial protection! By demystifying Gold IRAs via thorough evaluation surrounding leading companies offered today– investors get valuable insight allowing them make notified options customized particularly in the direction of unique objectives & & objectives they aim accomplishing within their particular portfolios! Whether you make a decision now’s prime-time show begin spending or choose wait till later on down line– knowledge acquired right here serves very useful regardless course taken moving forward!

In recap, when considering adding choices such as rare-earth elements into one’s profile– extensively looking into trustworthy carriers comes to be vital making sure successful changes happen efficiently without unexpected obstacles arising along way! Engage expert guidance whenever required while continuing to be alert concerning patterns unraveling throughout markets making sure strategies align efficiently around advancing scenarios encountered throughout trip ahead!

Find the Best Gold IRA Companies for Retirement

When you’re looking to secure your retirement with a Gold IRA, it’s essential you know what to take into account in choosing the right company. You’ll want to evaluate each provider’s reputation, fee structures, and the range of investment options they offer. A solid understanding of these elements will help you make an informed decision that aligns with your financial goals. But how do you sift through the myriad of options to find the one that truly meets your needs? Let’s explore the key features that can guide you toward making the best choice.

Understanding Gold IRAs

Gold IRAs offer a unique way to diversify your retirement portfolio. Unlike traditional IRAs that typically hold stocks and bonds, a Gold IRA allows you to invest in physical gold and other precious metals. This type of account combines the benefits of a self-directed IRA with the stability of tangible assets, providing a hedge against inflation and market volatility.

When you set up a Gold IRA, you can choose from various types of precious metals, including gold coins, bars, silver, platinum, and palladium. You’ll need to work with a custodian who specializes in these types of investments to guarantee compliance with IRS regulations. This custodian handles the buying, selling, and storage of your precious metals, making the process seamless for you.

It’s essential to understand that investing in a Gold IRA isn’t just about buying physical gold. You’ll want to take into account factors like storage fees, insurance, and the purity of the metals you choose.

Knowing these details can help you make informed decisions and guarantee your investments align with your retirement goals. By grasping the fundamentals, you’re better equipped to navigate the world of Gold IRAs confidently.

Benefits of Gold IRAs

When you consider investing in a Gold IRA, you’re looking at some key benefits.

It helps diversify your assets, acts as a hedge against inflation, and offers various tax advantages.

Understanding these points can make a significant difference in your retirement strategy.

Diversification of Assets

Investing in a Gold IRA can really enhance your portfolio’s diversification. By including gold in your retirement strategy, you create a buffer against the volatility of traditional investments like stocks and bonds. Gold often moves independently of these markets, which means when one experiences a downturn, the other might remain stable or even increase in value. This can help you maintain a more balanced investment approach.

When you diversify with a Gold IRA, you’re also tapping into a tangible asset. Unlike stocks or real estate, gold has intrinsic value and can serve as a safe haven during economic uncertainty. By holding physical gold, you’re not just relying on paper assets that can fluctuate based on market sentiment.

Moreover, diversification can lower your overall risk profile. A well-rounded portfolio minimizes potential losses, as different asset classes often perform differently under various economic conditions.

This means that by investing in a Gold IRA, you’re not only protecting your savings but also positioning yourself for potential growth in multiple areas. Embracing this strategy can lead to a more secure and resilient retirement plan.

Hedge Against Inflation

As inflation erodes the purchasing power of your savings, a Gold IRA can serve as a strong hedge against rising prices. When the economy faces inflation, the value of fiat currency tends to decline, making it essential to find assets that can retain their value. Gold has historically been viewed as a safe haven during such times, often appreciating when the dollar weakens.

By investing in a Gold IRA, you’re not just diversifying your portfolio; you’re also protecting your wealth from inflationary pressures. Gold tends to move in the opposite direction of the stock market and other paper assets. This negative correlation means that when inflation strikes and stock values fall, your gold holdings may increase, providing a buffer for your retirement savings.

Moreover, gold is a finite resource, which adds to its value over time. As demand for this precious metal rises globally, its price often follows suit.

Tax Advantages Explained

A Gold IRA offers significant tax advantages that can enhance your retirement savings strategy. When you invest in a Gold IRA, you can benefit from tax-deferred growth, meaning you won’t pay taxes on your earnings until you withdraw the funds during retirement. This allows your investments to grow more efficiently over time, as you won’t face immediate tax liabilities.

Furthermore, if you choose a Roth Gold IRA, you can enjoy tax-free withdrawals in retirement. You pay taxes on your contributions upfront, but once you’re eligible to withdraw, your earnings remain untaxed. This can be especially beneficial if you expect to be in a higher tax bracket when you retire.

Another advantage is the ability to diversify your retirement portfolio with a tangible asset like gold, which can provide a hedge against market volatility. By incorporating precious metals, you can potentially reduce your overall tax burden due to the unique tax treatment of physical assets.

Key Features to Consider

When searching for the right Gold IRA company, you’ll want to keep several key features in mind. First, consider the fees involved. You’ll encounter setup fees, storage fees, and annual maintenance fees. Understanding these costs upfront can save you from unexpected expenses later.

Next, look into the company’s reputation. Customer reviews and ratings can give you insight into their reliability and service quality. A company with a strong track record will likely provide a smoother experience.

Lastly, examine the investment options available. The best companies offer a variety of gold and other precious metals, providing you with flexibility in your investment strategy.

Here’s a quick comparison table to help you visualize these features:

| Feature | Importance |

|---|---|

| Fee Structure | Low fees save you money |

| Company Reputation | Trustworthy service matters |

| Investment Options | Diverse choices enhance growth |

Top Gold IRA Companies

When you’re choosing a Gold IRA company, it’s essential to take into account their reputation and trustworthiness.

You’ll also want to compare fees and costs, as these can greatly impact your investment.

Company Reputation and Trust

Choosing a gold IRA company often hinges on its reputation and trustworthiness. You want to guarantee that you’re partnering with a firm that has a proven track record of reliability and ethical behavior. Start by checking online reviews and testimonials from other investors. Platforms like the Better Business Bureau (BBB) can provide insights into the company’s history and customer satisfaction.

Look for companies that have been in the industry for several years, as longevity often indicates stability and trust. It’s also worth considering their affiliations with reputable organizations, such as the Industry Council for Tangible Assets (ICTA) or the American Numismatic Association (ANA). These memberships can reflect a commitment to maintaining high standards.

Don’t forget to investigate any complaints or regulatory issues. A transparent gold IRA company will readily address any concerns and provide clear information about their practices.

Fees and Costs Comparison

Understanding the fees and costs associated with gold IRA companies is crucial for making an informed decision about your retirement investment. When comparing different providers, you should consider several key expenses, including setup fees, annual maintenance fees, and storage costs.

Some companies may charge a flat fee, while others might base their fees on the total value of your account. You’ll likely find that setup fees can range from $50 to $300, depending on the company.

Annual maintenance fees typically fall between $75 and $300, but be cautious of providers that have higher fees without offering additional services. Storage fees for your physical gold can also vary; expect to pay between $100 and $300 annually, depending on whether the gold is stored in a segregated account or not.

Moreover, some companies might charge transaction fees for buying or selling gold within your IRA. Always request a complete fee schedule, and don’t hesitate to ask questions.

Investment Options Offered

A variety of investment options are available through top gold IRA companies, making it easier for you to diversify your retirement portfolio. You can invest in physical gold, such as bullion coins and bars, which are popular choices due to their intrinsic value.

Many companies also offer silver, platinum, and palladium, allowing you to spread your investments across multiple precious metals. In addition to physical assets, some companies provide options for investing in gold mining stocks and ETFs (Exchange-Traded Funds).

These alternatives can offer exposure to the precious metals market without the need to store physical assets. If you’re looking for a more hands-off approach, consider companies that offer managed accounts, where professionals handle your investments for you.

Don’t forget to check if the gold IRA company includes other options like cryptocurrency, which can further enhance your portfolio’s diversity. Each company’s offerings may differ, so it’s crucial to compare their investment options.

Understanding these choices will empower you to make informed decisions that align with your retirement goals. With the right mix of assets, you can build a robust portfolio that stands the test of time.

Comparison of Fees

When evaluating Gold IRA companies, comparing fees is crucial for making an informed decision about your retirement investment. Different companies charge various fees, including setup fees, annual maintenance fees, and storage fees, which can greatly impact your overall returns.

First, check the setup fees, which some companies might waive while others could charge hundreds of dollars. Annual maintenance fees vary too, so look for companies that offer competitive rates. You want to make certain these fees don’t eat away at your investment over time.

Next, consider storage fees, especially if you’re opting for a physical gold IRA. Some companies provide segregated storage, while others might use pooled storage. Segregated storage often comes with higher fees but offers added security for your assets.

Additionally, watch out for hidden fees, such as transaction fees when buying or selling gold. Transparent fee structures help you understand the true cost of your investment.

Customer Reviews and Ratings

Customer reviews and ratings play an essential role in selecting the right Gold IRA company for your retirement needs. By diving into what other customers are saying, you can gain valuable insights into the company’s reliability, customer service, and overall performance.

Look for patterns in the reviews. Are clients generally satisfied, or do you notice recurring complaints? Pay attention to how the company responds to negative feedback, as this can reveal their commitment to customer satisfaction.

When you see a company consistently praised for its transparency and support, it’s a good sign that they prioritize their clients’ needs.

Don’t just focus on the star ratings; read the detailed reviews. You might discover critical information about fees, account management, and the ease of transactions. Third-party review sites and forums can also provide unfiltered opinions, helping you form a well-rounded view.

Lastly, consider the company’s reputation in the industry. A strong track record can often be a more reliable indicator of future performance than just a handful of recent reviews.

Taking the time to analyze customer feedback will empower you to make a more informed decision about your Gold IRA investment.

How to Open a Gold IRA

Opening a Gold IRA can be a straightforward process when you understand the steps involved. First, choose a custodian who specializes in precious metals and is IRS-approved. Research potential custodians by checking their fees, services, and reputation.

Once you’ve selected a custodian, you’ll need to fill out an application to open your account.

Next, fund your Gold IRA. You can do this by transferring funds from an existing retirement account, like a 401(k) or traditional IRA, or by making a direct contribution. Be sure to check the annual contribution limits to stay compliant with IRS regulations.

After funding your account, you’re ready to purchase gold. Work closely with your custodian to select approved gold products, such as bullion or coins.

Tips for Choosing the Right Company

Choosing the right company to manage your Gold IRA can greatly impact your investment experience. Start by researching the company’s reputation; read reviews and check ratings on trusted sites. Look for feedback on customer service, fees, and overall satisfaction.

Next, ascertain the company is reputable and has experience in the gold investment space. Verify their credentials and check if they’ve been in business for several years. This can give you peace of mind that they understand the market and regulations.

Don’t overlook fees, as they can eat into your returns. Ask for a breakdown of all charges, including setup fees, storage costs, and annual maintenance fees. Compare these costs across different companies to find a fair deal.